In 2022, the center of gravity of copper price will be high before and low after: 75-57,000 Yuan/ton

Release time:2022-02-15Click:995

The first quarter benefited from a broad credit front, and there is still a staged rebound in demand. From the contradictory interpretation of the first quarter, although in the last two months the Federal Reserve has become more hawkish, and Europe has also started to raise interest rates, but as the market’s expectations of a liquidity squeeze have been repeatedly traded, the policy bears may have little short-term impact on the market, more of a long-term top suppression. Copper fundamentals remain supportive, with the global energy crisis since last year extending the post-epidemic mismatch between supply and demand, and global inventories remaining low, providing strong support for prices. After the Spring Festival, the issuance of domestic special bonds accelerated, the financial front is gradually cashed out, the market is optimistic about medium-term demand, copper is expected to remain strong in the first quarter, and prices are expected to oscillate within the high range since the second half of last year. Copper prices in 2022 is expected to move down the center of gravity, or before the high after the low trend, but will not “Back to the starting point.”.

A liquidity peak, will crowd out financial attributes premium liquidity overload is an important reason for the collective rise of commodities after the epidemic, liquidity peak contraction is bound to crowd out the financial premium of copper. As central banks around the world released liquidity after the outbreak, M2 growth in China and the US rose in tandem, particularly in the US, providing a liquidity premium for copper. Drawing on the historical experience after the financial crisis in 2008, China’s 4 trillion yuan plan and the four rounds of quantitative easing in the United States have boosted the growth rate of M2 between China and the United States. China’s credit expansion has been even stronger, and China’s M2 growth rate peaked at the end of 2009, copper prices peaked 15 months later, followed by a five-year cyclical downturn. After the 2020 outbreak, China’s monetary policy was more restrained, the United States lowered its benchmark interest rate to zero and released a total of $5.6 trillion in fiscal stimulus between March and 2021, and the M2 growth rate in the United States continued to rise sharply, until the 2021 peaked in March. Excess liquidity has provided a financial premium for the upward trend of copper after the outbreak, and copper faces the risk of a liquidity premium squeeze as global liquidity peaks and falls. The global liquidity policy tightens, the market regarding the Fed to raise the interest rate in March the anticipation continues to rise.Beginning in the second half of 2021, with the increase of vaccination rate, the sustained recovery of the economy and the increase of inflationary pressure, the market on the tightening of liquidity is expected to become stronger. The Fed maintained its “Inflation is temporary”stance until its Jackson Hole Airport meeting in August, but gradually shifted to a hawkish stance after the annual meeting of the world’s central banks. At its November meeting, the Federal Reserve announced that it would begin to slow its monthly net asset purchases by $10 billion and MBS BY $5 billion, based on its previous purchases of $80 billion a month in treasury bonds and $40 billion in mortgage backed securities, Taper will be completed in eight months. Beginning in December, when the Fed became more hawkish, Powell announced at the FOMC meeting that he would expand his tapering to $30 billion and end Taper early in March 2022. The UK has raised interest rates twice since the start of 2021, the European Central Bank governor has changed his tune, and expectations of a rate hike in March have risen significantly as US employment data continues to recover.

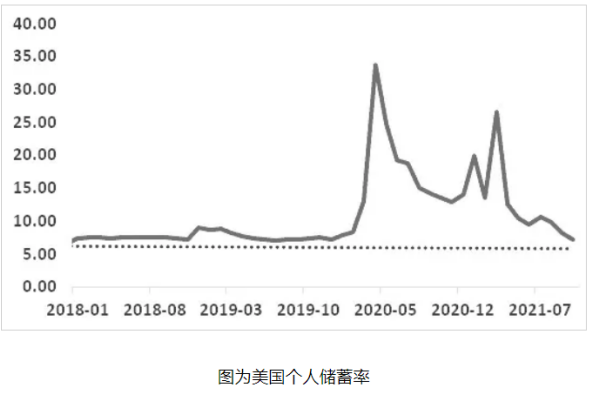

B external demand is expected to decline, domestic demand is expected to run smoothly after the outbreak of spillover effects of US fiscal subsidies to stimulate household consumption. After the outbreak, the Donald Trump administration unleashed four rounds of fiscal stimulus -- $8.3 billion, $104 billion, $2.2 trillion, and $480 billion -- in March and April 2020 for health care, unemployment insurance, and aid. Since the Biden Administration took office, the United States has launched a fiscal stimulus of $900 billion and $1.9 trillion. As a result of the extraordinary fiscal stimulus in 2021, the share of US fiscal spending in GDP was more than three times the average of previous years, on the income and savings of residents brought obvious spillover effect, driving the consumption of real estate and durable goods, industrial chain replenishment demand to pull the consumption of industrial goods. Fiscal tightening will curb consumption, replenishment cycle tends to end. As employment normalizes and inflationary pressures build up, there will be no need to hand out subsidies to households in 2022, when the deficit will halve as a share of GDP, according to the White House budget office.At present, the US personal saving rate has basically returned to the pre-epidemic level, the consumer confidence index has declined significantly, and the overseas demand, especially the demand for durable goods in 2022 is likely to weaken. In addition, inventories at U.S. manufacturers and wholesalers have returned to pre-outbreak levels, durable goods inventories at wholesalers are turning higher than before, the replenishment cycle is coming to an end, and the pull on industrial consumption is expected to weaken significantly. 2021 domestic demand continues to grow. In terms of refined copper table demand, scrap copper processing, dumping and storage regulation, the consumption of 2021 copper is about 13.77 million tons, up 3.5% year on year. The low peak season of 2021 consumption is not clear, due to the sharp rise in copper prices in the second quarter, high prices squeezed out some of the downstream demand, copper cable and Copper Rod operating rate appears to be a significant low peak season characteristics, copper Tube and strip foil start-up strength is also difficult to make up for the main consumption of the decline in the domestic refined copper in the second quarter of the off-season accumulation. After copper prices dropped in the third quarter, downstream demand recovered to a certain extent, but the power cut at the end of the third quarter was transmitted from upstream to downstream, affecting the processing industries in eastern and southern China, in addition to the recession in areas such as plate, strip and foil, the golden nine silver ten peak season characteristic also has not manifested excessively. Domestic demand expected to run smoothly in 2022. There are “Real estate, infrastructure,”the expected, but the real estate drag on copper consumption is relatively limited.

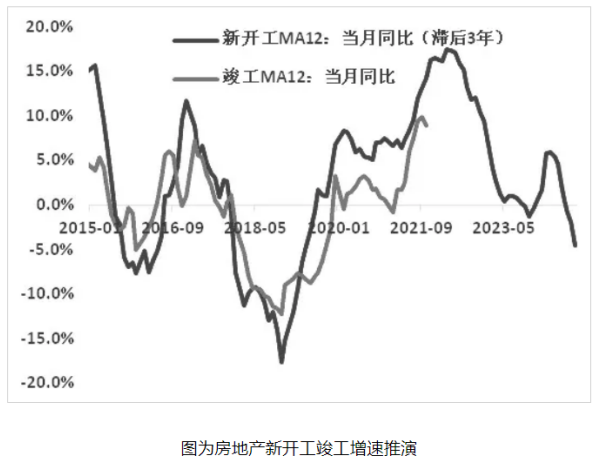

By comparison, it is found that the construction area, completed area and the investment growth rate of the construction and construction projects are high. Since the second half of the 2021, the weak sales of commercial housing and the restrictions on the financing end have caused the real estate investment and development to continue to decline, the growth rate of installation project and the growth rate of completed area fall down synchronously. In the fourth quarter, the margin of real estate financing was relaxed, the market generally expects that the policy bottom of real estate has appeared, and the sales and financing of commercial housing in 2022 are expected to improve, the drag on construction investment is expected to abate. In addition, by fitting the monthly year-on-year growth rate of new construction and completion, it can be found that the completion is basically three years behind the new construction, the growth rate of new construction is estimated, there is still a stock effect in 2022, supporting the completion growth to maintain a high level.

Broad credit to advance infrastructure, power grid investment is expected to maintain a high level, distribution networks to invest in good copper demand. After a politburo meeting on July 30th 2021 that “A proactive fiscal policy will enhance policy effectiveness, reasonably control the pace of budgetary investment and local government bond issuance, and promote the formation of a physical workload by the end of this year and early next year,” Broad credit has become increasingly popular in the market. The Sixth Plenary Session of the 19th Central Committee of the Communist Party of China in November and the politburo meeting in December continued to stress the importance of maintaining stable performance. Social Financing stock growth in early October signs of bottoming, counter-cyclical pressure, the first quarter of 2022 fiscal power or pre-positioning, to boost copper prices. Returning to the investment in the power grid itself, the State Grid said it would invest about 2.23 trillion yuan during the 14th five-year plan period, and the southern grid planned to invest 670 billion yuan, averaging about 580 billion yuan a year. The total level of investment remained high. In addition, the large-scale access of new energy puts forward higher requirements on the power supply capacity of the distribution network, and the State Grid in the Action Plan for building a new type of power system with new energy as the main body (2021 -- 2030) mentioned that the investment in the construction of the distribution network should be increased, the investment in distribution network construction during the 14th five-year plan period exceeded 1.2 trillion yuan, accounting for more than 60 percent of the total investment in power network construction.

The South Power Grid has also included distribution network construction in the 14th five-year plan, with a planned investment of 320 billion yuan, accounting for about half of the total investment. As the “Capillary”of the grid, copper is heavily used in distribution networks, and demand in the grid sector will underpin copper prices. Global auto production and sales are expected to benefit from the lack of ease of core, home appliances or pressure in the fall in external demand. In terms of durable goods consumption, the 2021 has seen a significant drop in global car production and sales, constrained by a shortage of chips. With the improvement of overseas epidemic and supply chain disruption and other issues, the market is expected to chip shortage after MID-2022 will be significantly eased, car production and sales are expected to be boosted. Household appliance consumption and exports in the first half of 2021 still maintained high growth, after the second half of the recession began to fall, in the overseas financial subsidies end, durable goods demand peak drop in the background, domestic household appliance production affected by the risk of drag.

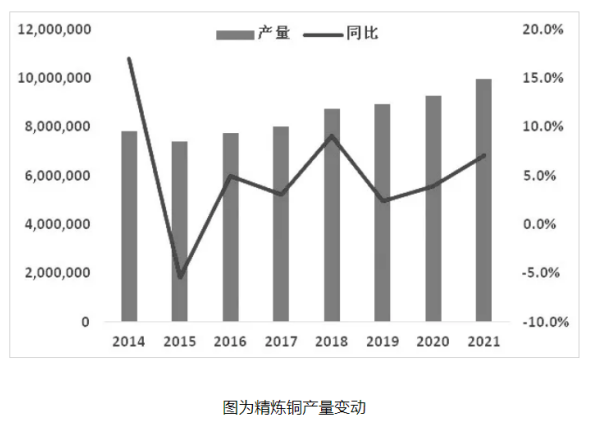

The supply of primary copper (C) continued to recover, the supply of secondary copper concentrate (cu) was tight, and the supply of long copper concentrate (TC) moved up in 2022. According to the production plan announced by the major mines, the increment of the 2021 copper mine is expected to exceed one million tons, and the total volume of imported copper concentrates in China rose by more than 6% in October from a year earlier. The incremental releases in 2022 will continue, with mines such as Kamoa-Kakula, Grasberg, Chuquicamata and Timok all contributing more than 100,000 tonnes of incremental releases, while the total amount of copper concentrates planned to be released will still exceed one million tonnes. SMM expects a surplus of about 150,000 tonnes of copper concentrate supply relative to smelting capacity, with the long-order TC of copper concentrate moving up to $65 in 2022. Production of refined copper will reach nearly 500,000 tons in 2022, easing refinery production restrictions. In 2022, both domestic crude and refining capacity increased significantly, with new capacity such as Huiying, Daye and Zhongtiao Mountains and the resumption of production in the Dongying area or contributing nearly 500,000 tons of capacity increase. From the refinery profit level, copper concentrate TC is expected to continue to rise, but sulfuric acid prices are expected to drop stronger, refinery profit may be lower than this year’s peak, but is expected to remain above the median. From the perspective of external constraints on the production environment, the second half of 2021 has repeatedly mentioned the campaign-style carbon reduction, and the political bureau meeting in December mentioned the coordinated arrangement of coal, electricity, oil and gas transportation to guarantee supply. Since 2022, both domestic and foreign attitudes toward carbon reduction have eased. The policy on the most serious impact of electricity restrictions has passed, 2022 smelter production of external constraints objectively reduced, conducive to the realization of new production capacity.

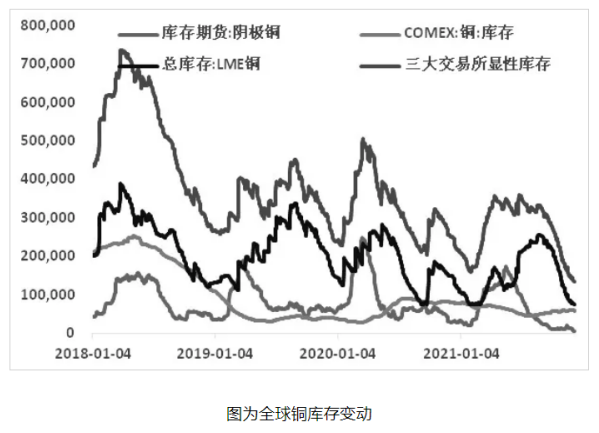

Global Dominant inventories remain at a record low, with a recovery forecast for 2022. After the fourth quarter of 2020 marked the lowest level of global dominant inventories in a decade, inventory levels fell again in the second half of 2021, with significant implications for the current structure. Since the third quarter of 2021, the LME price differential has climbed as high as $1,100. On the back of low inventories, domestic spot prices have risen in tandem. After a slight drop in copper prices in November, spot premium rose to a 10-year high of 2,000 yuan. Looking forward to 2022, we are expected to gradually improve the status quo of low inventory, with the gradual recovery of refinery production, domestic inventory levels are expected to bottom up, inventory inflection point may gradually appear in the first quarter. The circulation of low-grade wastes is limited, and the price difference between refined wastes is difficult to be improved obviously. 2021 imported 1.23 million tons of copper scrap in September, up 81% from the same period in 2020.

After the dust settled on China’s waste import policy, there was a new change in overseas waste import and export in the 2021. One is Malaysia, China’s largest source of scrap copper imports, which is set to tighten import standards for scrap metal after 2021, requiring imports of scrap copper to be above 94.75% , basically up to China’s import standard for recycled copper. The other is that the EU says it will restrict solid waste exports to third-party countries that do not meet EU environmental standards. Waste policies in Malaysia and Europe have a strong impact on low-grade waste. It is reported that the export of Brass in Europe began to be affected in November. From the perspective of the domestic industrial structure, due to the rapid growth of domestic scrap copper rod and brass rod production capacity, the 2021 estimates that the production capacity of both will reach the level of 6 million tons and 3 million tons respectively, and the scrap copper market is in a state of short supply, the price difference between refined and waste is kept at a low level, and the operating rate of scrap copper rod and brass rod is basically in the range of 50%-60% . Due to the mismatch between supply and demand in 2022, the price gap between refined and waste is not expected to improve significantly, and the copper scrap market will continue to be tight supply.

D Futures Holdings and 2022 outlook futures stagflation and near-far and near-month price spreads pull in line with the end of the rising cycle. On the Back of low inventories, domestic and overseas copper futures structures turned strong, the price differential of 2021 rose to an all-time high of $1,100 per ton in the third quarter, and the spot premium of Shanghai copper rose above $2,000 per ton, but in the second half of the copper basic maintenance high oscillation market, the futures stagflation characteristic is obvious. In fact, the strong reality of weak expectations in line with the upward cycle into the tail of the characteristics. In the weak expectations of the suppression of futures prices, especially the far-month contract prices were significantly suppressed, but low inventory of the strong reality still needs time to ease, bullish sentiment through the long-term spread to release. Into the late fourth quarter, futures Back structure at home and abroad significantly weakened, the market support gradually weakened, or indicates that the price inflection point is approaching. Overseas speculative multi-position drop significantly. There has been a significant upward trend in both speculative net LME and non-commercial net long Comex positions in the post-2021 cycle. But after 2021 hit an all time high for copper in the second quarter, overseas speculative long positions declined significantly, particularly Comex positions, and overseas sentiment on copper continued to weaken.

The centre of gravity will move down in 2022, but not “Back to square one”. The global liquidity peak will squeeze out the financial premium, the supply recovery from ore to smelting, the decline in overseas durable goods consumption and the ending of replenishment cycle will ease the post-epidemic mismatch between supply and demand, copper in the face of financial attributes and commodity attributes of the dual downward pressure, the price center of gravity is expected to move down. But domestic demand tends to be stable, copper will not be a large surplus in the year, after the Chinese New Year benefit from domestic wide credit front, copper prices may still have staged a rebound in demand. In addition, the new demand cycle generated by new energy sources has given copper new consumption growth point, long-term copper prices are expected to rise at the bottom, the trend after the reversal of copper will not be “Back to basics.”. In 2022, the Shanghai Copper Center of gravity is expected to be high and low, with the main operating range of 57,000-75,000 Yuan/ton and the Luntong operating range of 77,000-10,000 US dollars/ton.

Source: Hongyuan Futures

Disclaimer: Some pictures and texts on this site are collected from the Internet and are only for learning and communication. The copyright belongs to the original author and does not represent the views of our site. This site will not bear any legal responsibility. If your rights are violated, please contact us to delete it in time.